2023 Mobile Industry Recap: Mobio Group Report

To stay competitive and effectively engage with audiences, companies have to proactively optimize their digital strategies. In this article, Mobio Group’s mobile marketing team will review data from statistical sources that will help provide insight into the state of the mobile market in 2023, attracting and retaining users, prioritizing growth initiatives, entering new markets, and optimizing ROI.

Mobile Growth

The global digital advertising industry is projected to be worth $602.25 billion at the beginning of 2024, with mobile advertising accounting for 61%.

According to Data.ai research, the global app market is making a comeback after facing macroeconomic headwinds in 2022. Mobile ad spending reached $362 billion, up 8%, and the average time users spend in mobile apps surpassed the five-hour threshold, up 6% year-on-year.

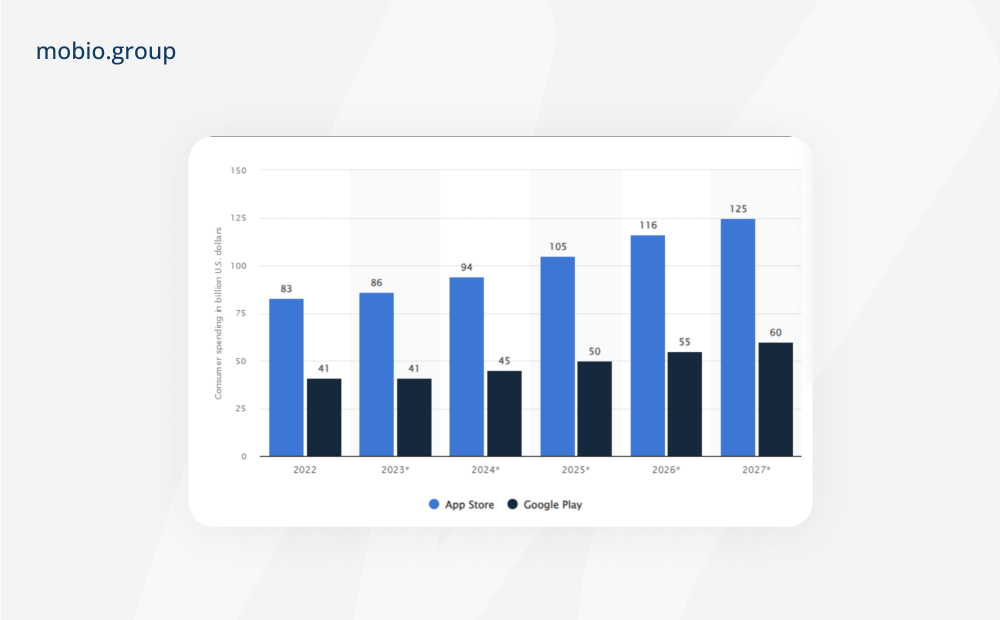

This growth indicates that the downturn in 2022 was short-lived. Statistical Platforms give a favorable outlook for global consumer spending on mobile apps in the future:

The recovery of the mobile application market after past difficulties emphasizes the sustainable potential and viability of the mobile sphere.

Geo

In 2023, the global average mobile growth score across all verticals is 29.9 (Adjust calculates the score based on three key metrics: number of installations, CPI and LTV). Asia Pacific (APAC) was the clear winner with 43.3, followed by Europe with 35.9 and North America with 30, Middle East, North Africa and Turkey (MENAT) with 29.5 points, while Latin America (LATAM) was close behind with 27.9 points.

Among countries, India (31.2), USA (29.4), Brazil (29.3), Indonesia (27.8) and Turkey (27.6) lead the mobile Growth Score.

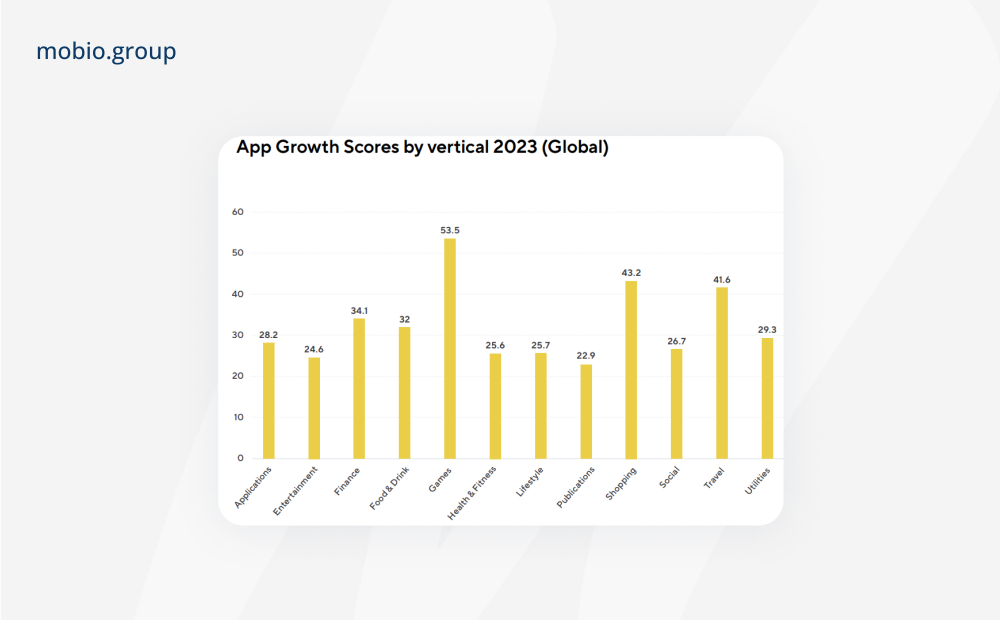

Verticals

Despite a challenging 2022, gaming app installs recovered significantly at WW in 2023, contributing to a higher growth rate (53.5). Shopping apps had the second highest growth rate (43.2), followed by travel apps (41.6), finance apps (34.1) and food & drink apps (32).

Crypto apps saw the most significant success in verticals, with a 454% increase in installations in the first half of 2023 compared to the 2022 average. In comparison, educational apps have seen an 18% growth in installs over the same period.

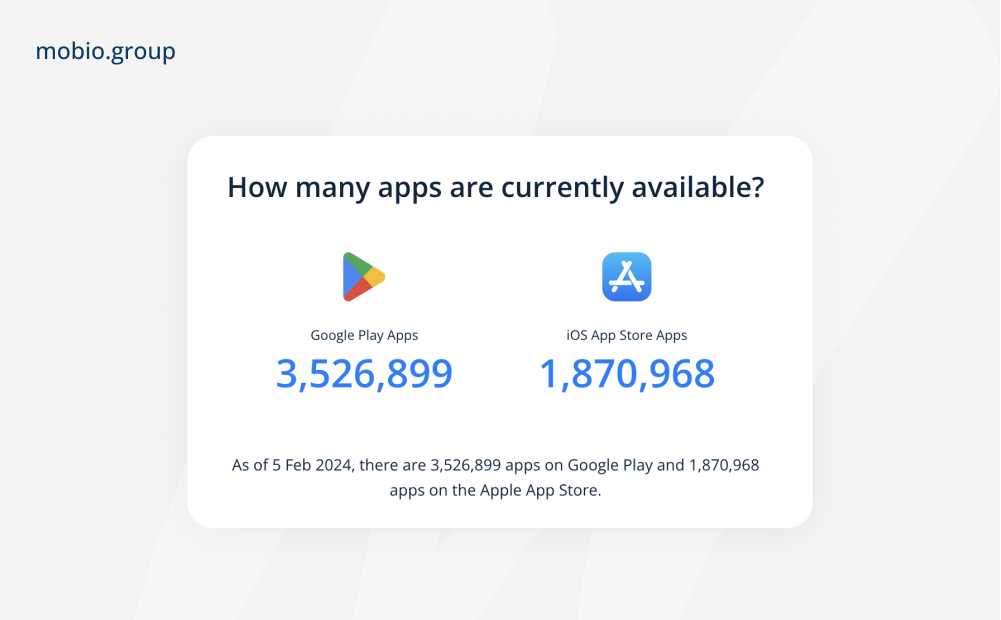

The number of available apps also continues to grow with Google Play leading the way:

The parity of game apps by the end of 2023 remains at 11-12% of the total number of apps in the stores. Paid apps out of all apps available for download account for an average of 3% on Google Play and 5% in the App Store.

Companies continue to increase investment in advertising. The United States accounts for the largest share of ad spending, at nearly 40% (according to the DemandSage report). The average increase in mobile ad spending by companies was +25.7% year-on-year:

Over 90% of Brands Have a Social Media Presence

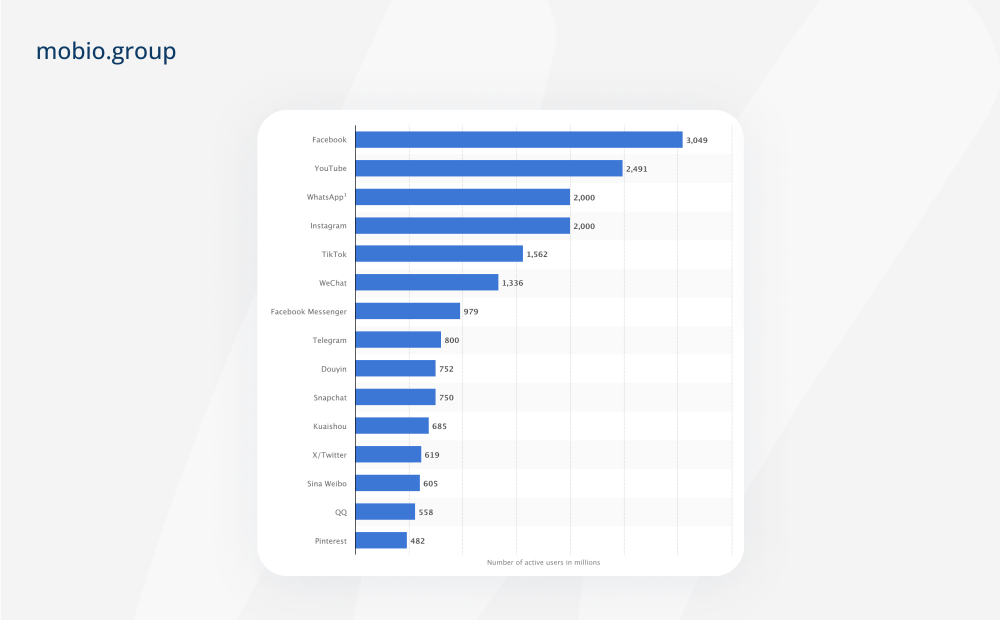

The optimistic performance was largely driven by a recovery in advertising demand, reflecting the industry’s resilience on social media. More than 90% of brands are running social media campaigns based on the activity and engagement of their users. The world’s most popular social networks by number of active users per month:

Kepios analysis shows that user growth actually accelerated in the third quarter of 2023. Snapchat posted best-in-class growth, with global daily active users up 13% year-over-year (driving a 15% share price increase), followed by Instagram (+10%), TikTok (+6%) and Facebook Blue (+2%). X (formerly Twitter) is the only social network to show a significant year-over-year DAU decline of 10%.

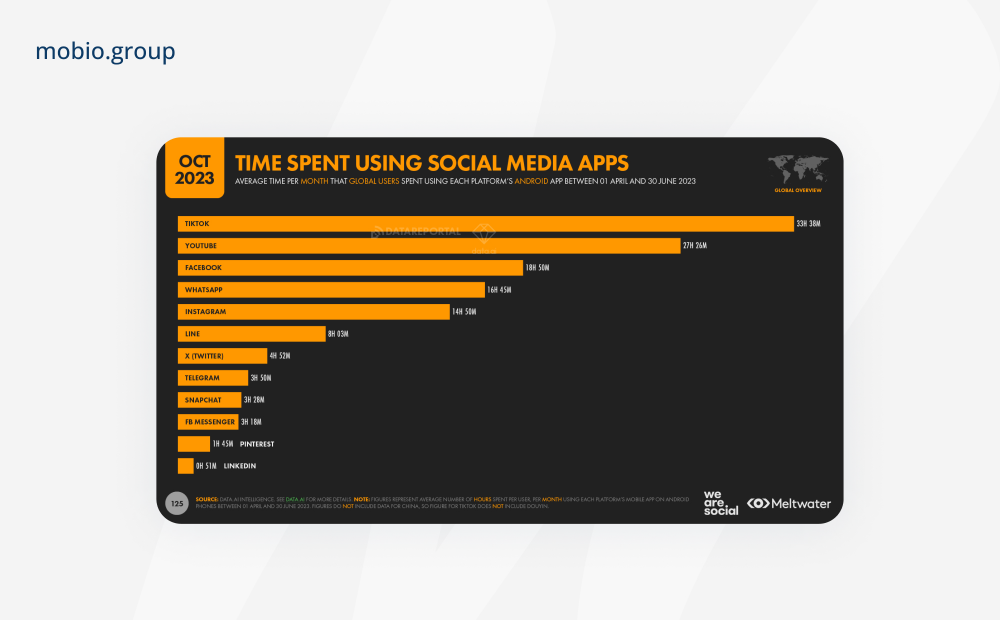

However, in terms of the amount of time spent by a user in a social network per month, TikTok is the leader, outperforming Facebook by almost 2 times.

Meta

Meta reported exceptional results for Q3 2023, beating revenue and EPS forecasts despite a drop in ad reach in the 13-17 age group due to Meta’s ban on advertisers using detailed targeting for this audience.

According to Meta’s latest quarterly report, nearly 3/4 of advertisers (about 10 million) now advertise on Facebook pages. Number of Facebook users in different regions of the world:

- Asia-Pacific — 1.35 billion (India is the leader)

- Europe — 409 million

- USA and Canada — 270 million.

Statistically, a Facebook user clicks on 12 ads every month. Facebook ads have an average price per click (CPC) of — $1.72, an average conversion rate (CVR) of 9.21%, and an average click-through rate (CTR) of 0.9%.

India also leads in the number of Instagram users with 327million. It is followed by the US (169 million), Brazil, Indonesia and Turkey. 44% of users use Instagram for shopping on a weekly basis. According to the emplifi report, 87% of brands used Instagram Reels for their advertising, a 26% increase from last year. Despite a 30% drop in user engagement, Reels from brands earned an average of 75 interactions per post and Carousels earned an average of 74 median interactions with posts.

YouTube

Despite the fact that 2023 is the only period in YouTube’s history when the video hosting site’s audience did not grow, YouTube ranks as the 2nd most popular social network in the world in terms of monthly active users. Google claims in its “Why Video” study that 70% of viewers make a purchase from a brand after watching its video ads on YouTube.

Over 2023, the number of active advertisers using TrueView for action has grown by more than 260%, but small businesses are still just beginning to embrace YouTube. In the US, for example, only 9% of small businesses utilize YouTube as an advertising platform.

TikTok

The first app in history to have user spending exceed $1 billion in a quarter (Q1 2023). Although brands create only 3.7% of content on TikTok, 90% of tasks with branded hashtags generate a 2.5x ROI on advertising on this channel. To give you an example, the popularity of videos with the hashtag #NFT grew by 93,000% last year. The dynamically growing hashtags are #fintok and #stocktok.

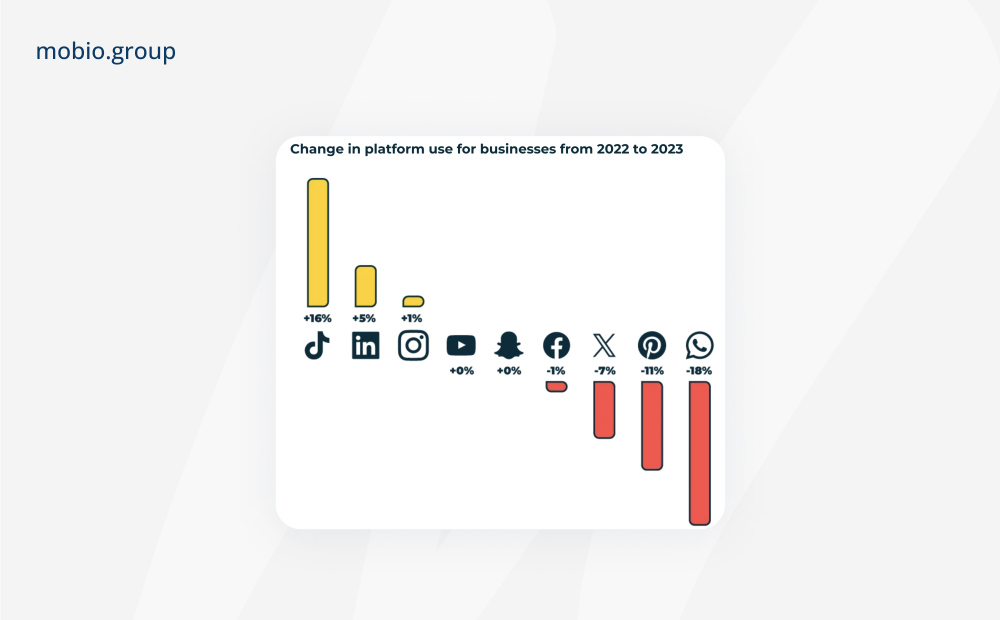

After viewing a dynamic advertising showcase on TikTok, 74% of Generation Z weekly TikTok users will search for more information about the advertised product, and 72% will remember the brand even 3 weeks after seeing an ad on TikTok (according to TikTok Marketing Science). In 2023, the problem of ROI in social media has become more acute. This is due to the difficulty for brands to maintain a presence on many networks simultaneously, as the average user visits seven networks each month (Demandsage report). In 2024, businesses will have to prioritize their own ROI for each platform and make business decisions accordingly.

The challenge of choosing an advertising channel in 2024 is particularly relevant given the increasing trend of platforms to opt users out of paid advertising. For example, Meta plans to offer users in the EU, EEA and Switzerland in 2024 the option to pay a monthly subscription and use Facebook and Instagram without ads. The price for such a service is planned to be €12.99 per month on iOS and Android.

AI in Marketing

The marketing and advertising market is leading the adoption and use of generative AI in 2023 (37%) according to Statista. The other two sectors showing growth in AI usage are technology (35%) and consulting (30%).

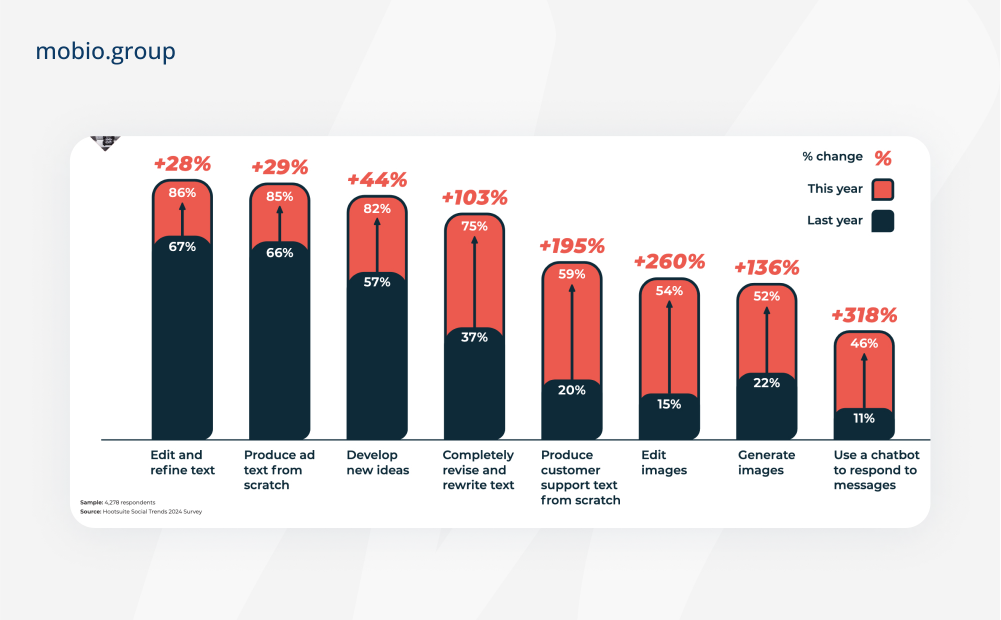

In 2024, the number of companies that plan to use AI tools for customer support will increase by 318% (according to a Hootsuite survey), for image creation and editing by 260%. This trend is leading to brands rethinking the concept of authenticity. In 2024, the question of content provenance (via AI or traditional methods) will lose its relevance. A brand’s ability to create memorable user experiences will take center stage.

The strong connection between devices and everyday life, and the ongoing digitization of all aspects of life are creating opportunities for growth and progress in the mobile app market. In 2024, as in 2023, digital marketing changes will focus on mobile effectiveness with a focus on user experience (UX), integration of advertising and influencer campaigns, and social media activity that shows growth in user numbers and engagement metrics.