Review of Data.ai’s Mobile App Industry Report for 2024 | Mobio Group

Data.ai, a company specializing in app and data analytics with a strong focus on AI, has made significant progress. Using innovative AI technology, they have analyzed historical and recent data to predict upcoming trends in the mobile app industry for 2024. Such forecasting is an invaluable tool for strategic planning. The Mobio Group team invites you to join us and look into the future.

Artificial Intelligence

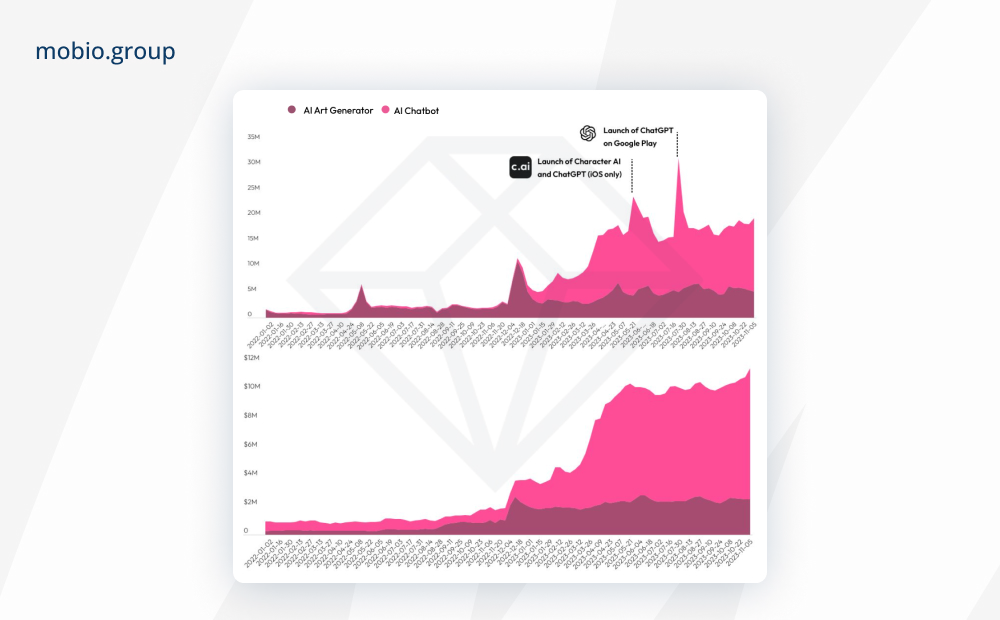

With the launch of ChatGPT in 2023, a new era of AI has opened up. The number of Google searches for the word “Artificial Intelligence” in the US increased 10x and the number of AI generative app downloads increased 9x compared to 2022.

AI-based chatbots showed a rapid 72x growth, making them stand out as a separate mobile app trend.

Apart from AI Chatbots and AI Generator, a fairly broad category of apps that utilize artificial intelligence saw a 60% increase in downloads in 2023. These are mostly photo and video editing apps with AI-based functionality.

Prediction

The number of app downloads with generative AI features is expected to grow by 40% to reach a staggering 2.3 billion in 2024.

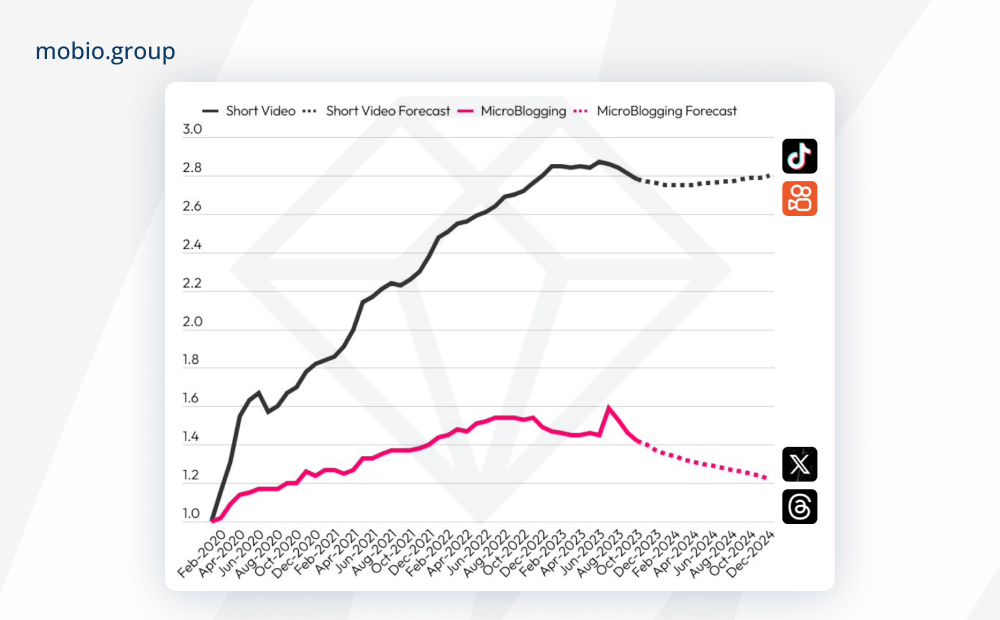

The Decline of Microblogging and the Rise of TikTok

The decline in popularity of microblogging is attributed to increased competition and a shift in user preferences away from text-based social networking apps towards photo and video-oriented platforms. The once mighty X (ex. Twitter) is facing challenges not only from competitors and a series of management and image-building failures, but also from changing user consumption of news. In particular, TikTok has significantly displaced X’s news platform: 43% of US TikTok users now use the platform to get news, twice as many as three years ago, while for X this figure has fallen from 59% to 53% over the same period of time. Video is now becoming the king of news.

Prediction

The microblogging space, once dominated by platforms such as X (ex. Twitter) and Threads, is set to see a decline in 2024. X is predicted to face a drop in daily active users (DAU’s) to 250 million.

TikTok Continues its Rapid Growth

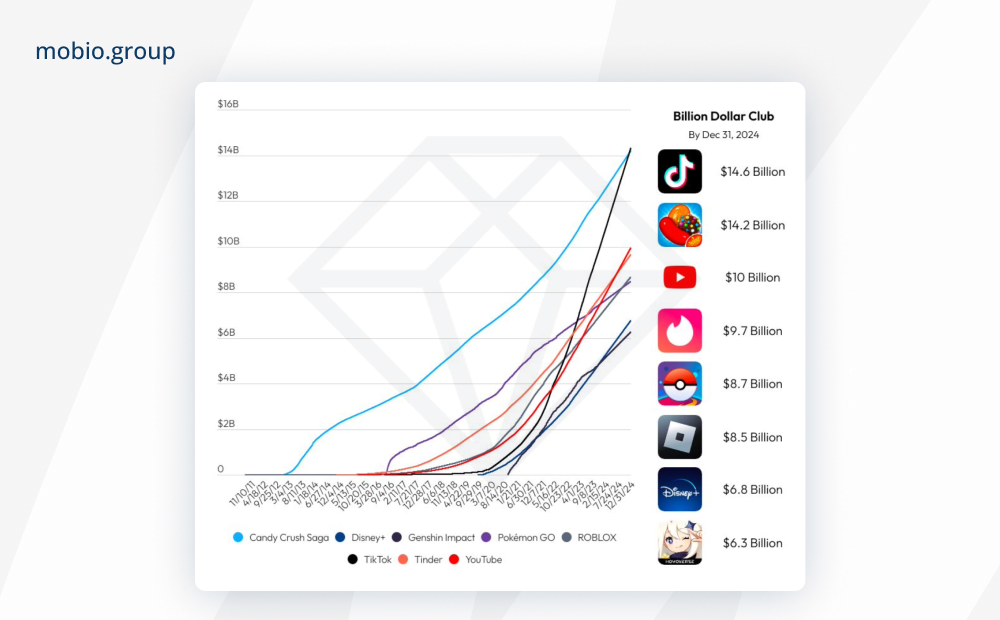

In 2023, total spending at TikTok grew 70% year-on-year, outpacing the 3.7x growth of popular match-3 game Candy Crush Saga.

Prediction

TikTok could surpass Candy Crush Saga as the highest-earning app, approaching the $15 billion mark in 2024 and earning more than $11 million per day.

Gambling Spending: A Sustainable Recovery

In gaming, 2024 will see a sustained recovery. Despite a 3% drop in consumer spending in 2023, 2024 is set to reverse the trend with a 4% year-on-year increase to $111.4 billion. This recovery, while not reaching the peak levels seen during the COVID-19 pandemic, indicates a more moderate growth trajectory.

The US is expected to play a major role in the gambling spending revival, accounting for 40% of the year-over-year spending growth, Japan — 16%, as well as South Korea, Taiwan, Germany and the UK. Most of the growth in spending will be driven by the RPG, Match, Party and Casino genres, with RPG and Match accounting for a significant share — accounting for $1 of every $5 of cumulative spending growth.

However, there could be potential downsides such as macroeconomic implications, a ban on fingerprints in advertising, the rise of alternative app stores and regulation of the gaming industry, especially in China, the largest gaming market in the world.

The Evolution of Social Media Revenue

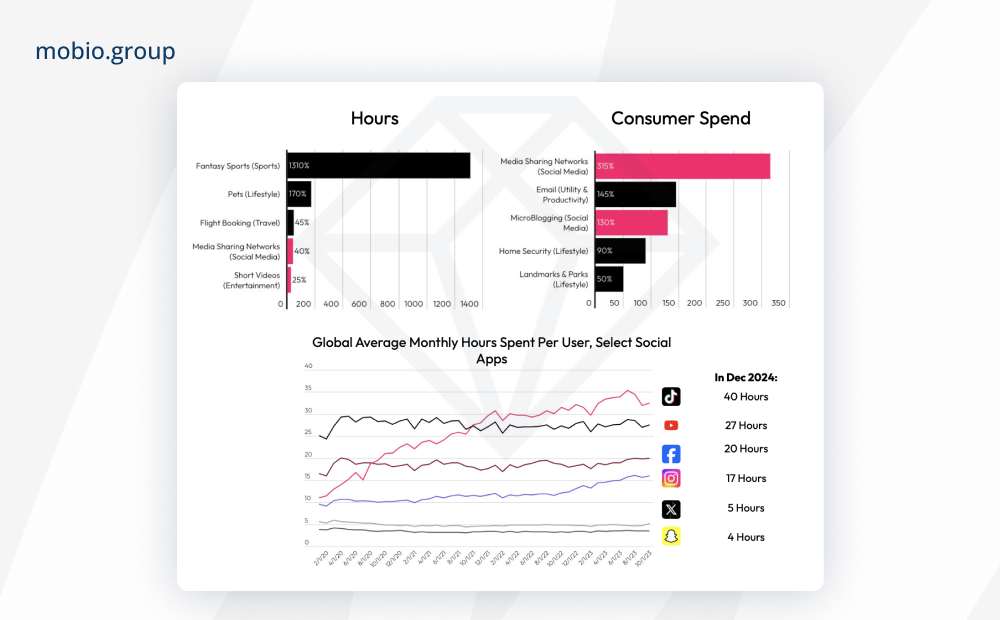

For social media, 2024 marks a shift in revenue models. Historically reliant on advertising revenue, social media platforms are now using in-app purchases as a direct source of consumer spending. Specifically, in 2024, consumer spending on media sharing networks will increase 152% to approximately $1.3 billion. In this way, consumers will take a share of advertisers’ spending.

TikTok, a pioneer in this direction, introduced In-App Purchases to “tip” content creators, revolutionizing how users engage and spend money on the platform.

In January 2020, TikTok users spent 11 hours per month on the app. By October 2023, that figure had tripled to 32.5 hours per month. By December 2024, the average TikTok user is projected to spend 40 hours per month on the app, surpassing even YouTube. Competitors such as YouTube, Instagram and Snapchat are rapidly rolling out similar features, including gifs and subscriptions, diversifying their revenue streams. Other social apps, including X, are facing declining user numbers and reduced ad revenue by introducing fees for account verification and ad removal.

AI excels at comprehensive data analysis and predictive analytics. Its potential to uncover patterns and anticipate trends makes it a powerful ally for marketers to develop strategies that are not only reactive, but also proactive.

At the same time, mobile marketing is a very dynamic field and is affected by various external factors. Therefore, it is important to realize that this forecast should not be taken as a direct guide to action, but rather as potential trajectories and benchmarks from which to draw valuable insights.

Well, let’s see in a year’s time what will come true.