Data.ai’s State of Mobile for 2024. Mobio Group Overview

Data.ai, a company specializing in app and data analytics, has recently published its traditional Mobile Apps Industry Report 2023. It not only offers a comprehensive overview of the overall state of the mobile app market. It also sheds light on specific trends in various app categories. Mobio Group team invite you to read the key metrics and findings outlined in this informative report.

Macro Mobile Trends

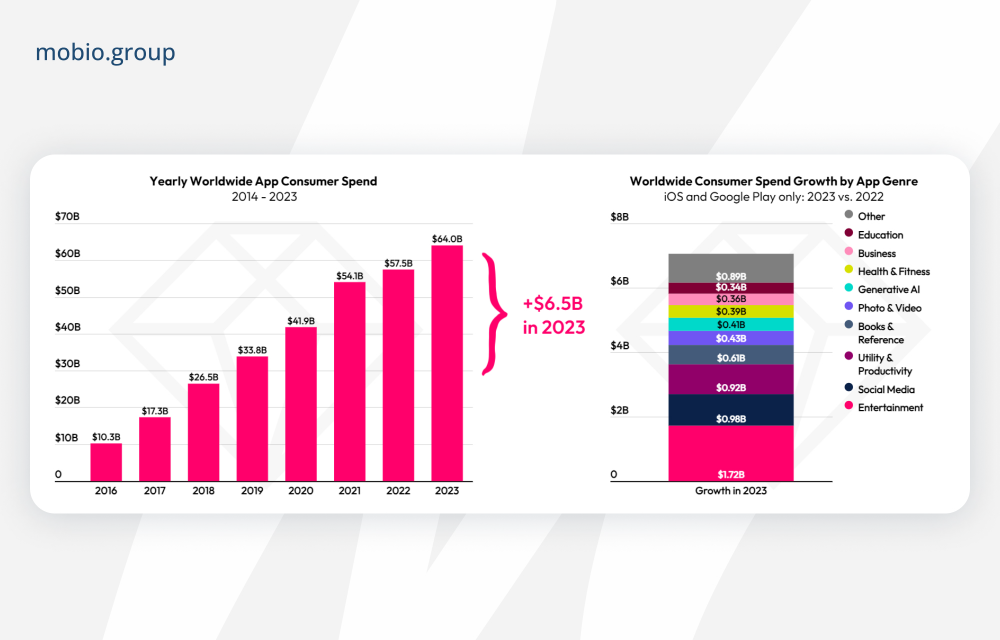

The world is becoming increasingly mobile-centric: compared to 2022, in 2023 users downloaded 1% more apps, spent 3% more in them, and spent as much as 10% more time on mobile devices.

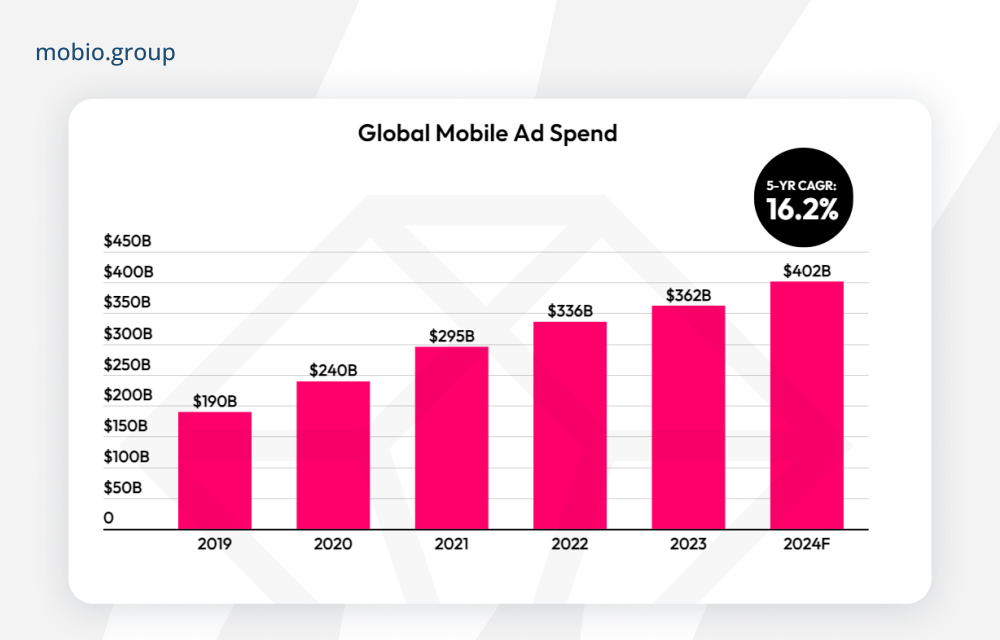

It’s only logical that mobile ad spend is also increasing, up 7.5% in 2023. Advertising spending is projected to exceed $400 billion in 2024.

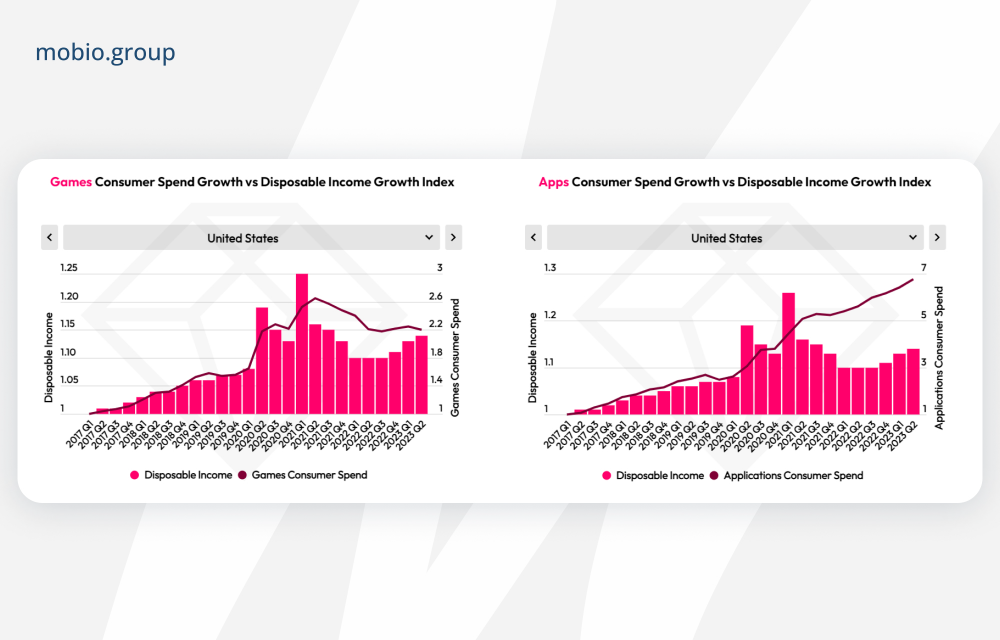

Spending on games is highly correlated with user revenue, while non-gaming apps, which often represent “essential” services, are showing more resilience, especially as mobile payments become more commonplace.

In 2023, more than $60 billion dollars was spent on non-gaming apps by users, mostly on entertainment and social media.

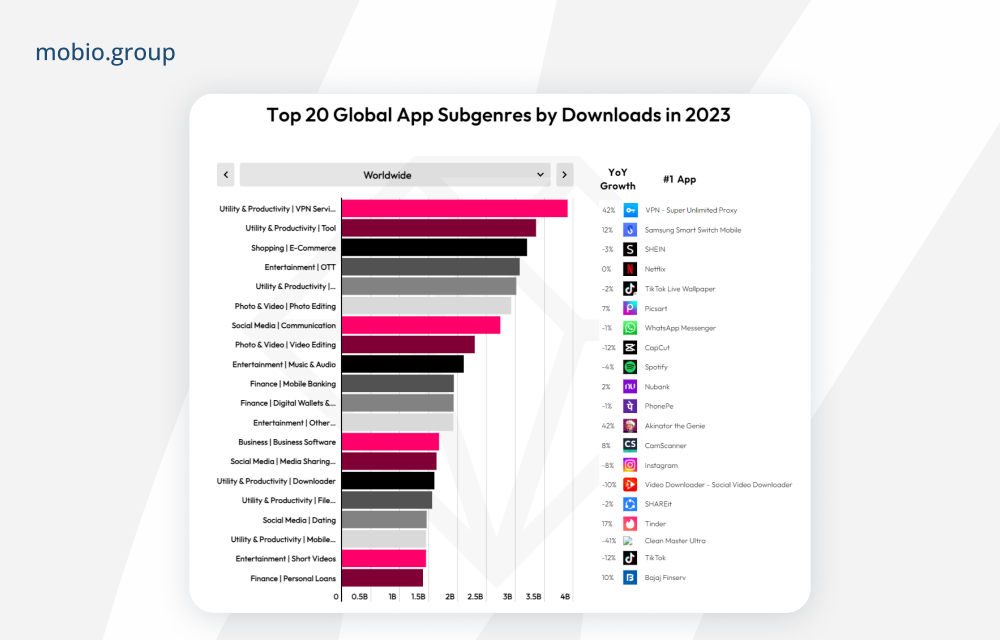

The 2023 leaders in downloads:

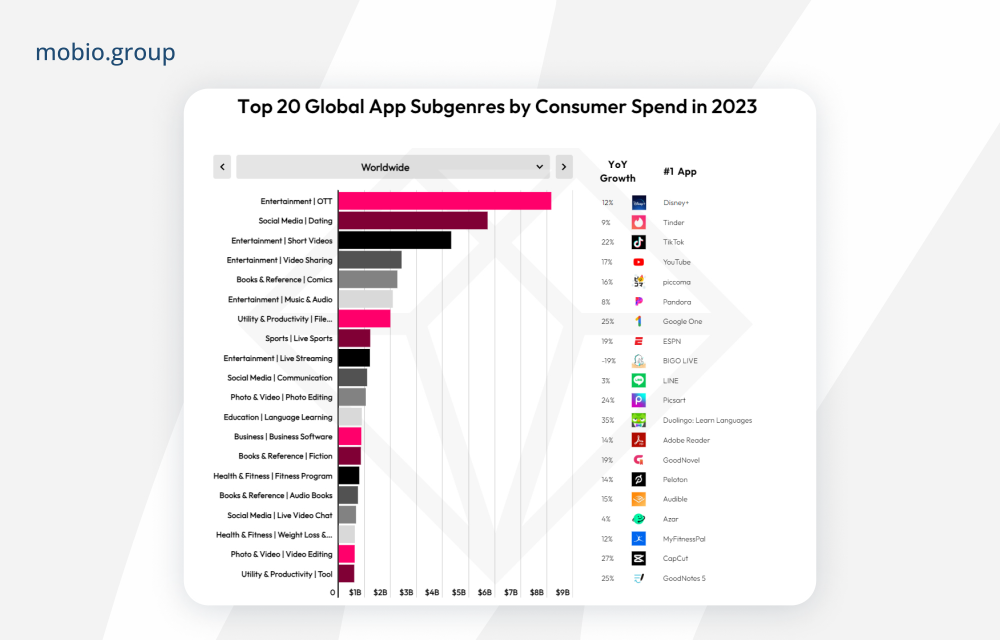

The 2023 Leaders in Consumer Spending:

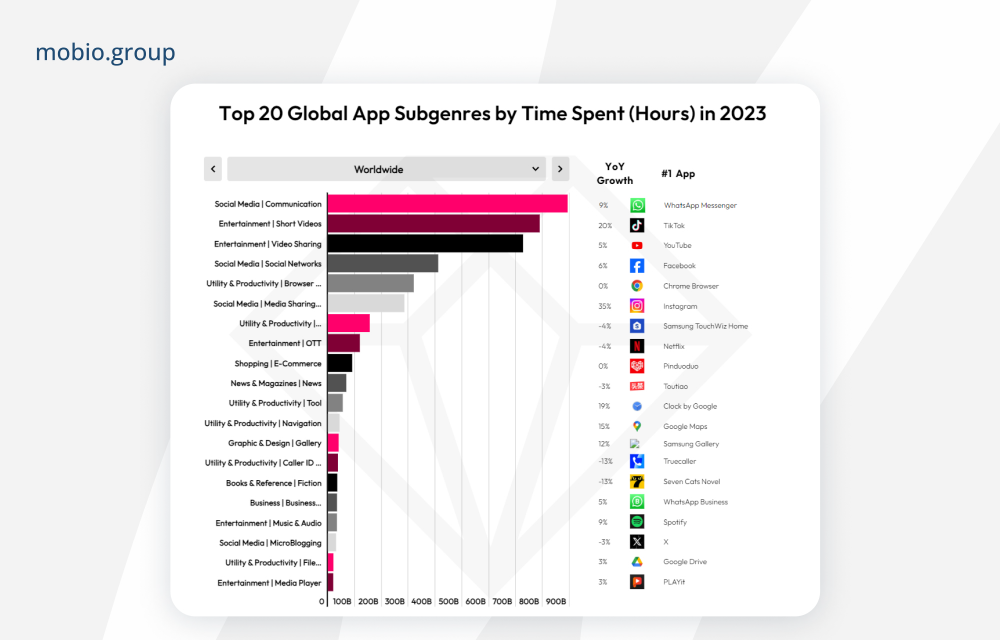

The 2023 Leaders in terms of time spent:

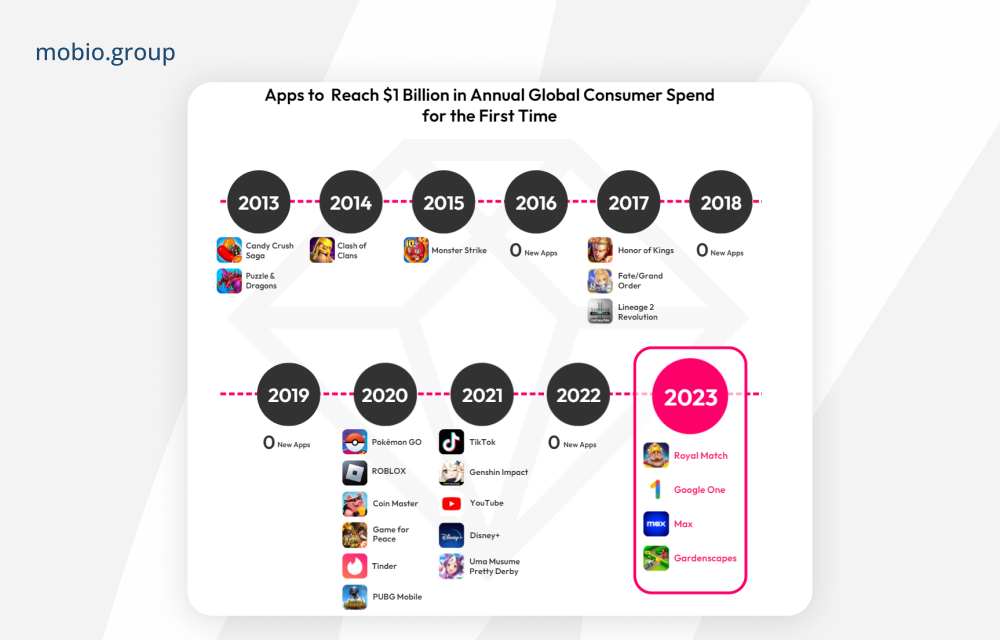

In 2023, the milestone of $1 billion in annual global consumer spending was crossed for the first time by four apps (there were no such apps in 2022) of which two were non-gaming apps (Google One and Max).

AI on Mobile

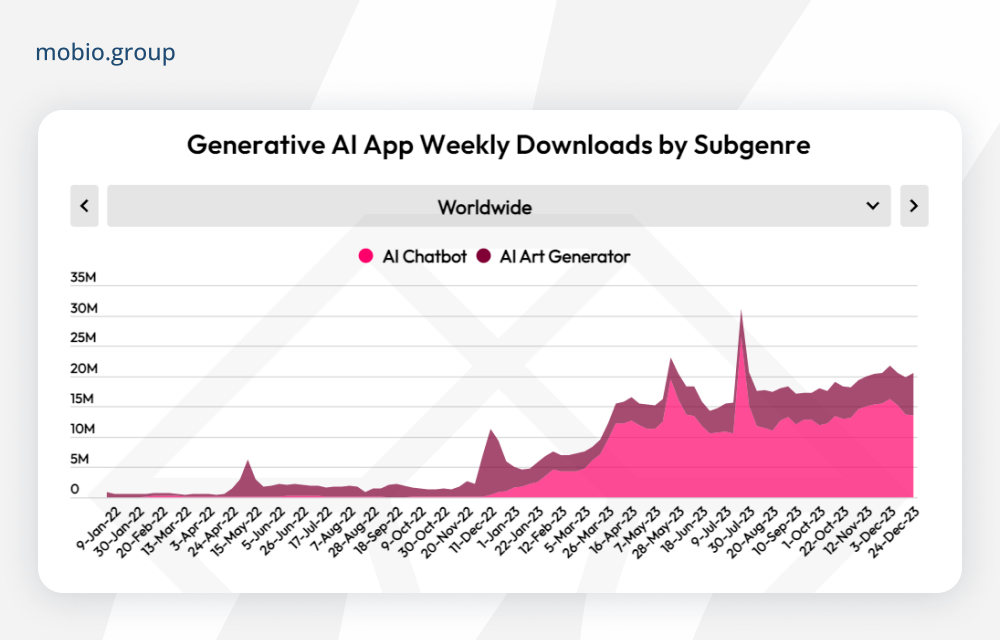

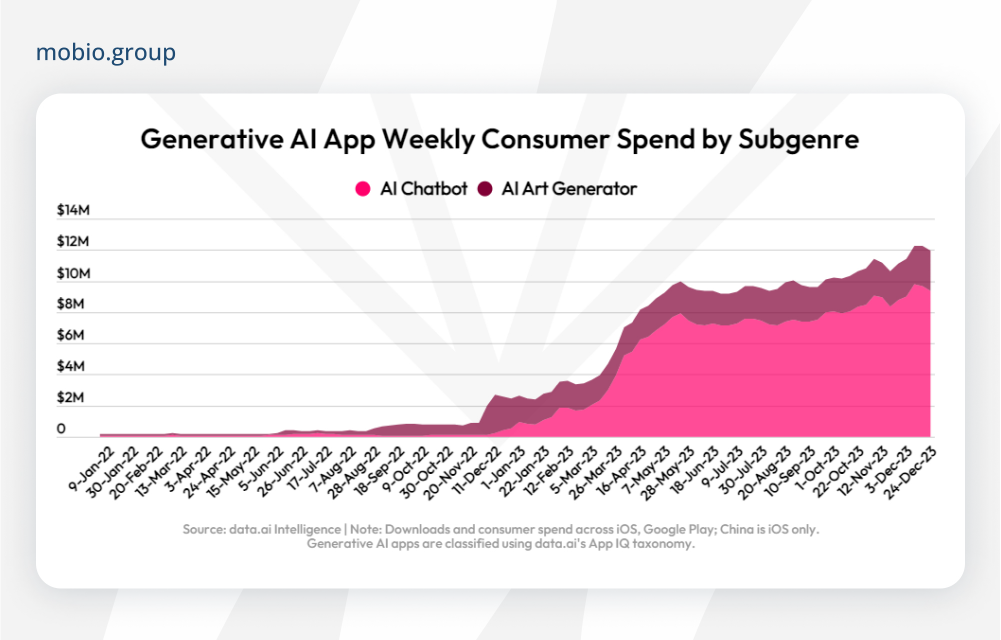

In 2023, AI has had a significant impact on the entire world, including the mobile technology industry. More and more mobile apps are implementing AI, thus generative AI has become one of the fastest growing genres. Only in some Asian and Middle Eastern markets including China, Japan, Saudi Arabia and Turkey has AI not made it into the top five genres.

With the launch of ChatGPT and Character AI in late 2022, there has been a surge in the popularity of AI-enabled chatbot apps. Their ubiquity maintains its momentum even today.

Consumer spending in these genres has shown the same consistent upward trend through 2023.

AI is being implemented in all categories of mobile apps: from social apps (Snapchat), to educational platforms (Duolingo), to the financial sector (Wells Fargo).

Numerous apps have appeared in the iOS and Google Play app stores mentioning AI-powered features. More than 4,000 apps had the word “chatbot” in their description, and more than 3,500 used the term “gpt.” The phrases “ai art,” “ai write,” and “chatgpt” are also popular in the title and description of apps.

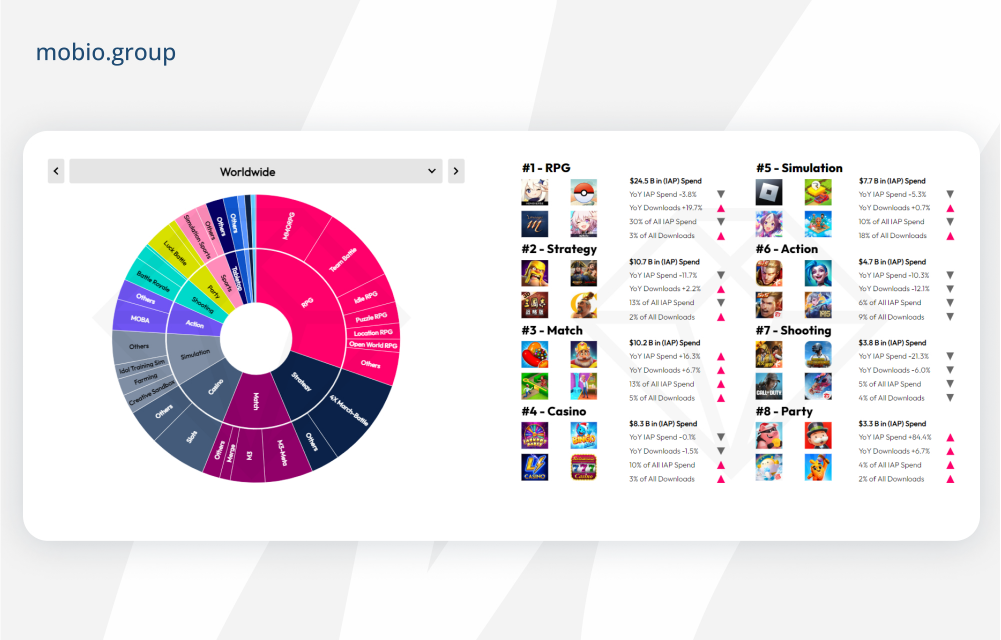

Gaming

While demand for games continues to perform strongly, consumer spending continues to decline for the second year. Down 2% in 2023, they totaled $107.3 billion.

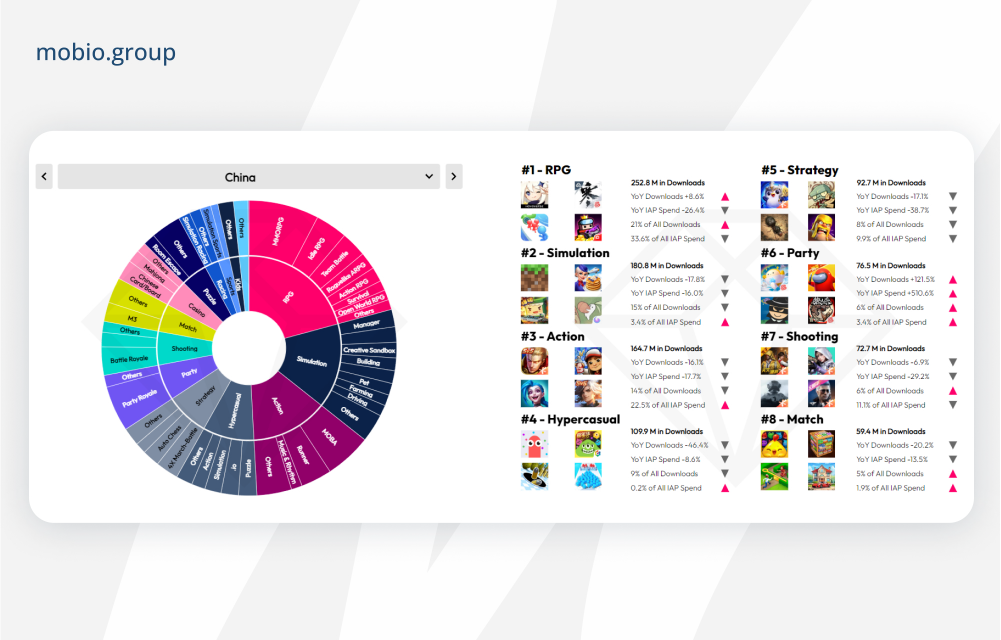

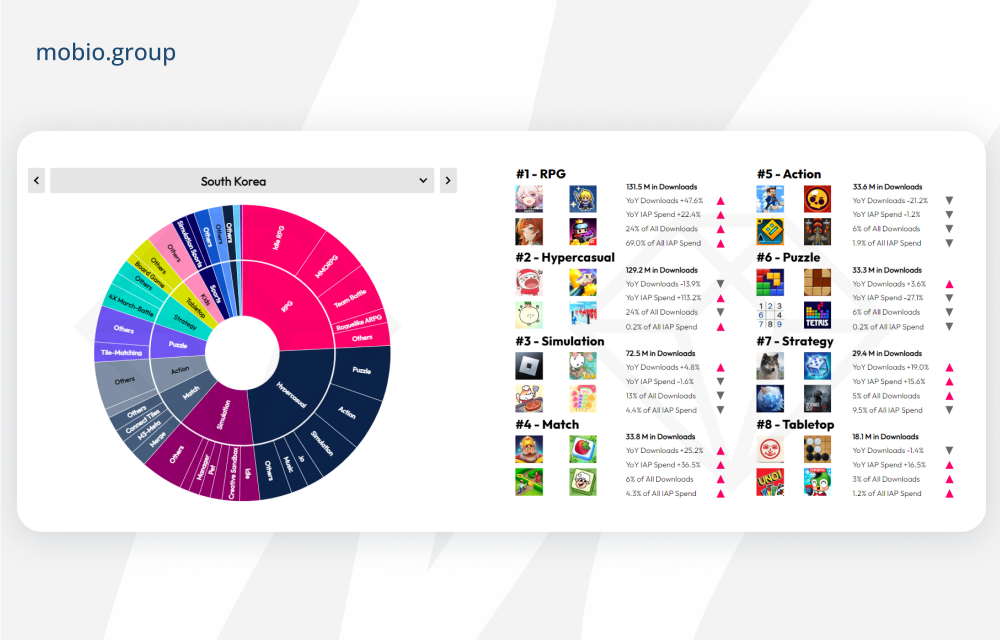

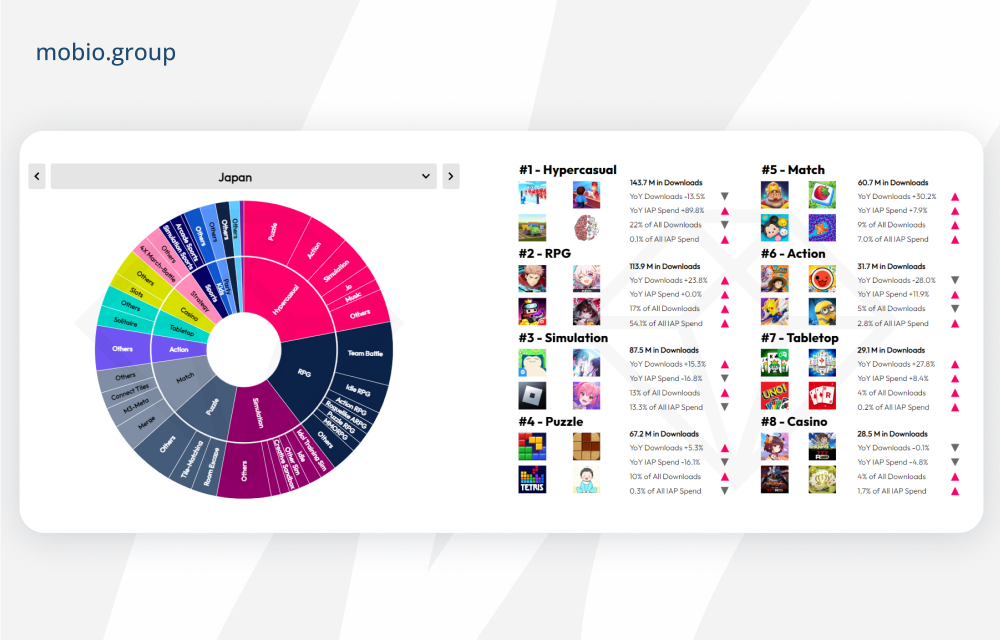

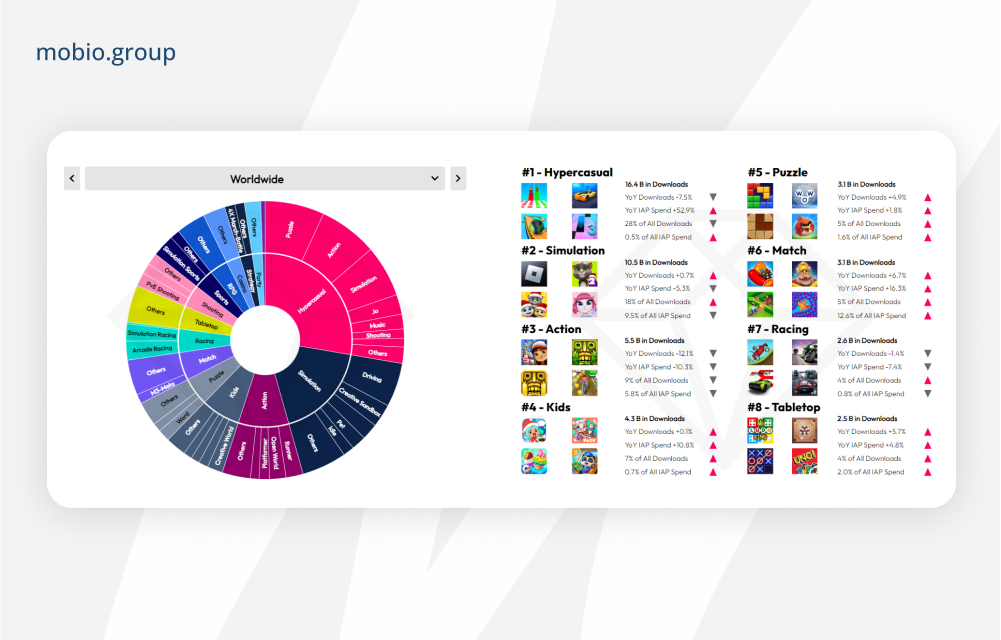

In most countries, Hypercasual, Simulation, Action and Puzzle games are leading the way in terms of downloads.

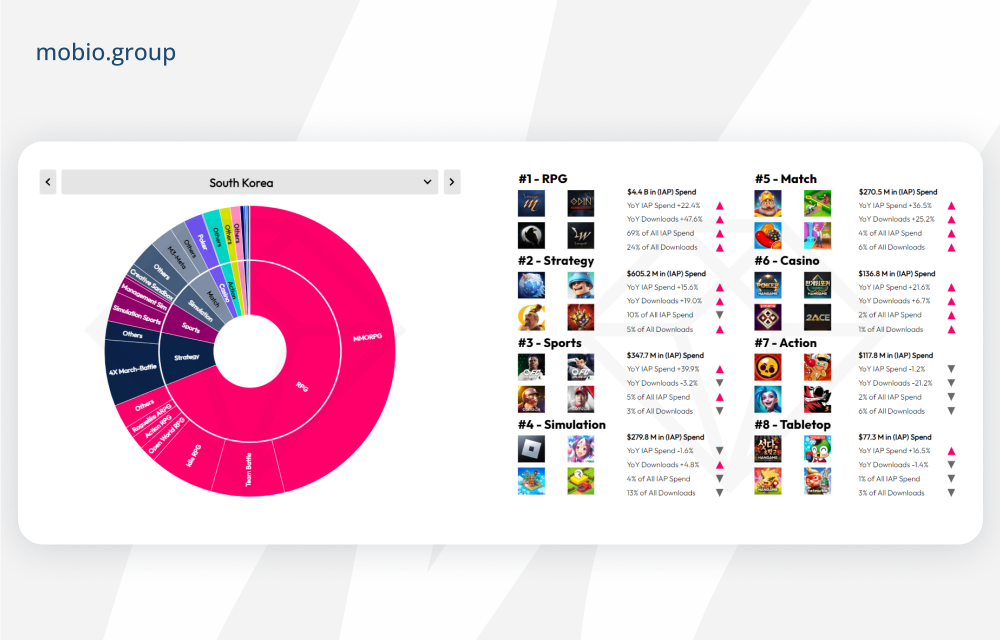

But in the Asian market, the balance of power is changing a bit and RPG games are taking the lead.

At the same time, in terms of consumer spending, games of the RPG genre firmly hold the first place in the global market. In 2023, they amounted to 24.5 billion dollars, which is 2.5 times more than the Strategy genre, which is in second place in this ranking. And in South Korea, RPGs account for nearly ¾ of all gaming consumer spending.

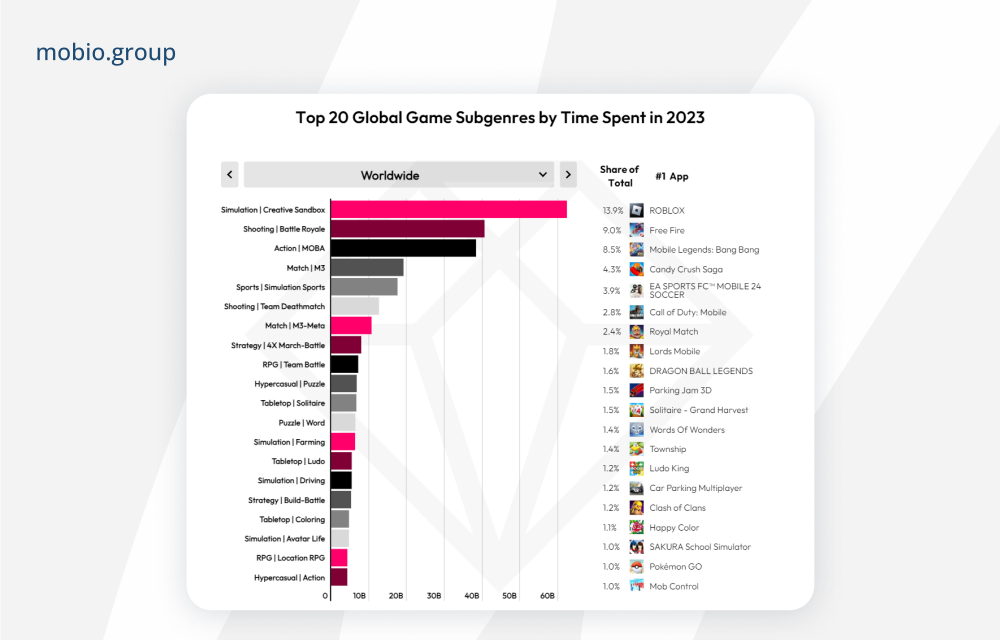

In terms of user time, the Creative Sandbox subgenre with the game ROBLOX is clearly in the lead.

New genres such as Avatar Life (Gacha Life 2) and Party Royale (Eggy Party) have significantly increased downloads and users and could have a strong impact on the mobile gaming market in the future.

Finance

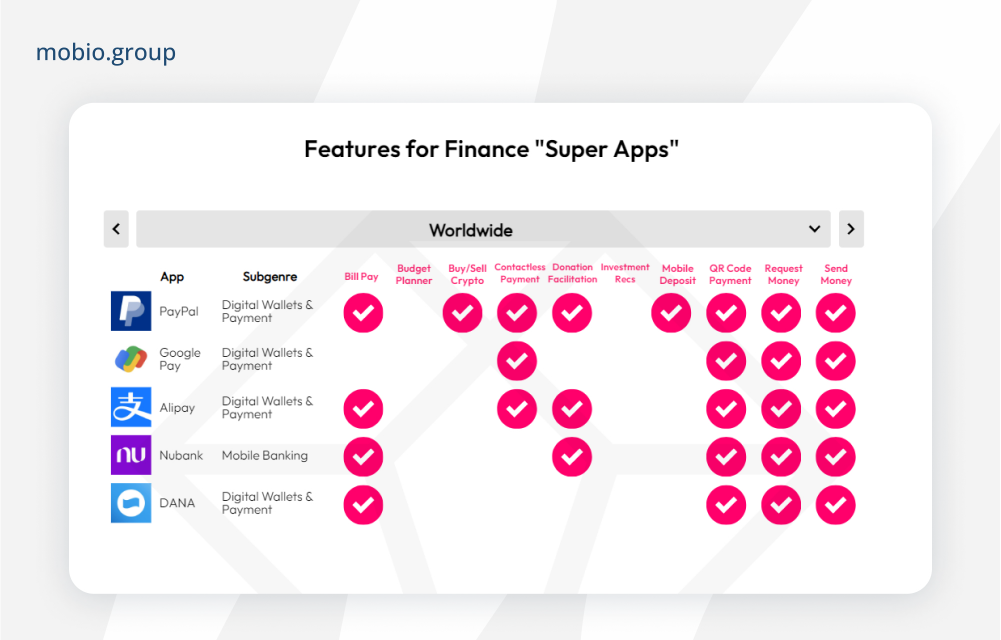

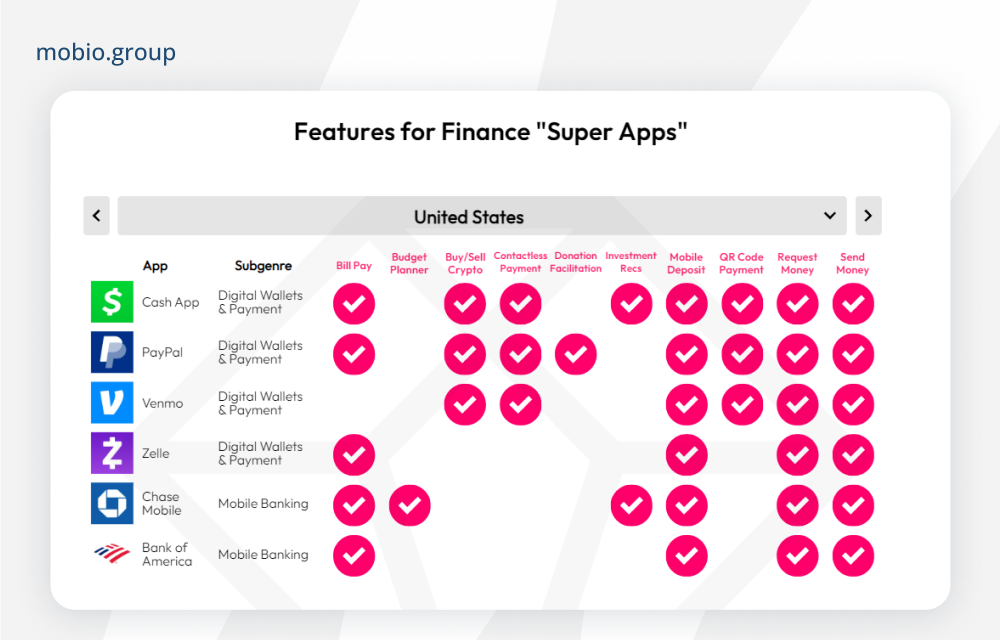

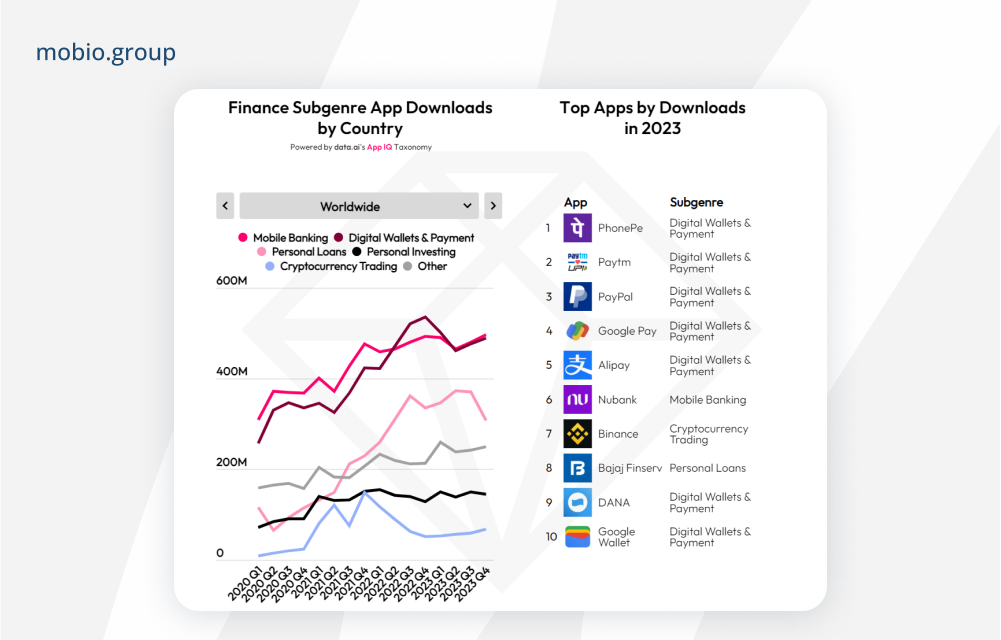

Users are increasingly using mobile apps to solve their financial tasks. The most popular apps are those in the Mobile Banking and Digital Wallets and Payments categories. The number of downloads of personal lending apps is also quite high, but this category has a strong regional character: such apps are in particular demand in India, Indonesia and Mexico.

As before, all markets are dominated by local publishers, as knowledge of each country’s financial rules and legal regulations, as well as an understanding of consumer needs, is essential. The predominance of local publishers is particularly strong in China, Japan, South Korea and the United States.

Cryptocurrency Trading app downloads in 2023 have leveled off after a strong decline in 2022, but their popularity mainly depends on the state of the cryptocurrency market.

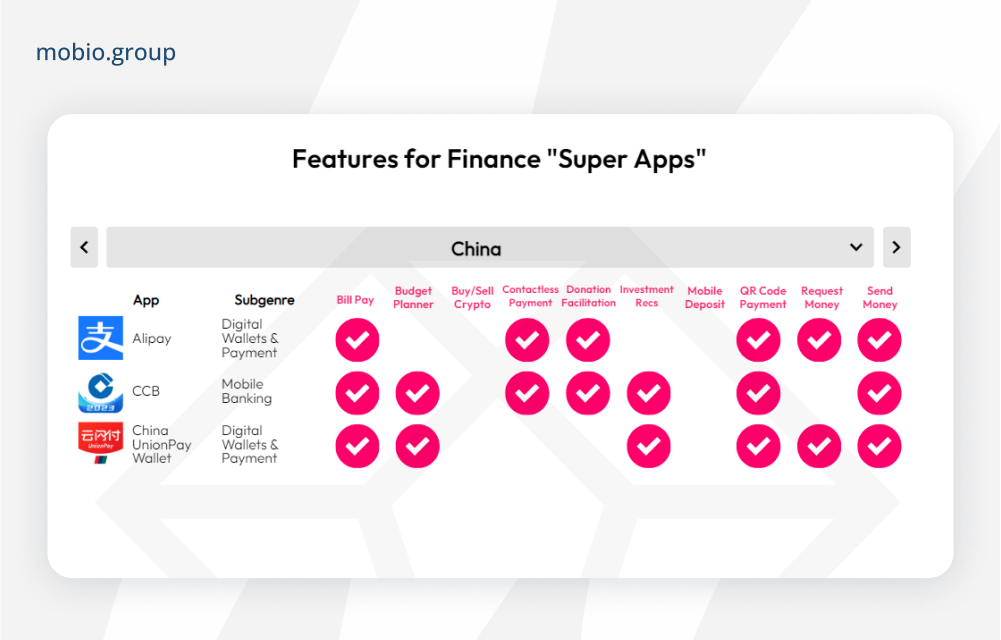

In a highly competitive mobile market, leading financial apps are constantly improving their offerings by introducing new features to attract users looking for comprehensive financial solutions covering mobile banking, fund transfer and cryptocurrency trading. This concept of “super apps” has gained significant traction. Each of the world’s leading markets has at least one app offering four or more of these features.

Notably, countries such as the US, UK, China and Brazil boast the presence of three or more such apps, often making them leaders in the financial sector. In fact, these super apps control more than 20% of the monthly active user base in finance in China (47%), the US (32%) and Argentina (24%).

Retail

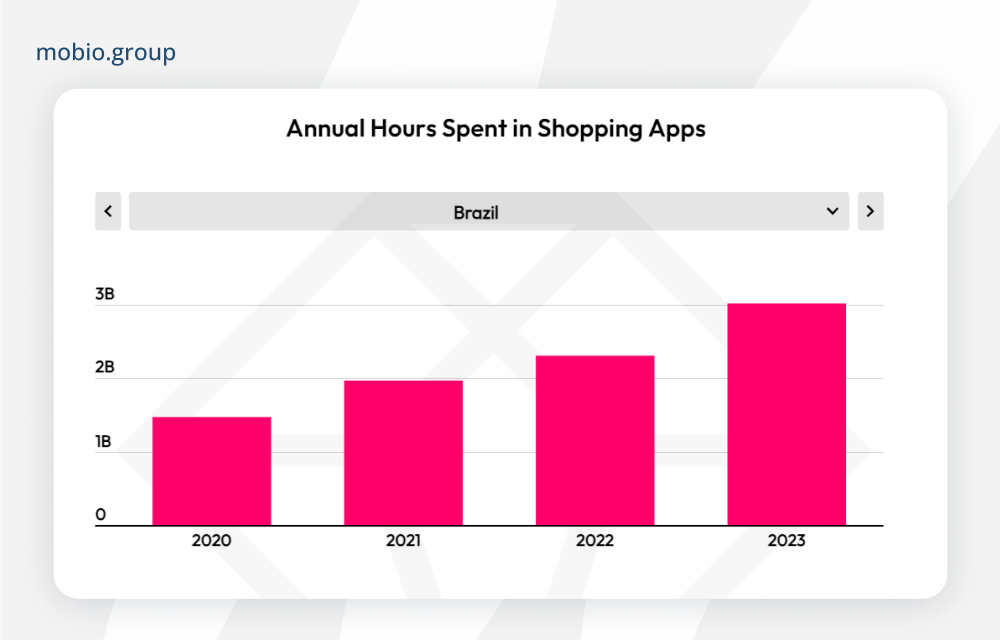

During the pandemic, users began spending significantly more time shopping on mobile apps, and this continued to remain high in 2023, showing a decrease of just 1%.

The largest increases were seen in the markets of Brazil (+31%) and Australia (+13%).

A slight decrease in time was noticeable in the US (-4%) and China (-0.2%) markets, while the largest decreases were seen in Thailand (-16.2%) and Indonesia (-14.5%).

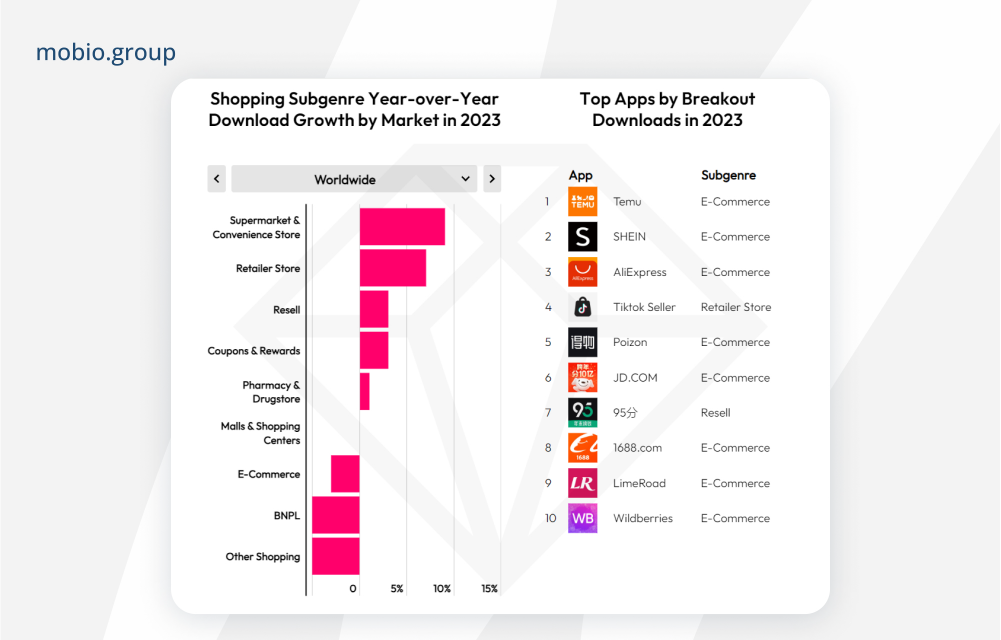

Applications of Supermarket & Convenience Store and Retailer Store categories were the leaders of growth in the number of app downloads (+9% and +7%, respectively).

Obviously, giving customers the opportunity to purchase through an app greatly increases the competitiveness in the retail market.

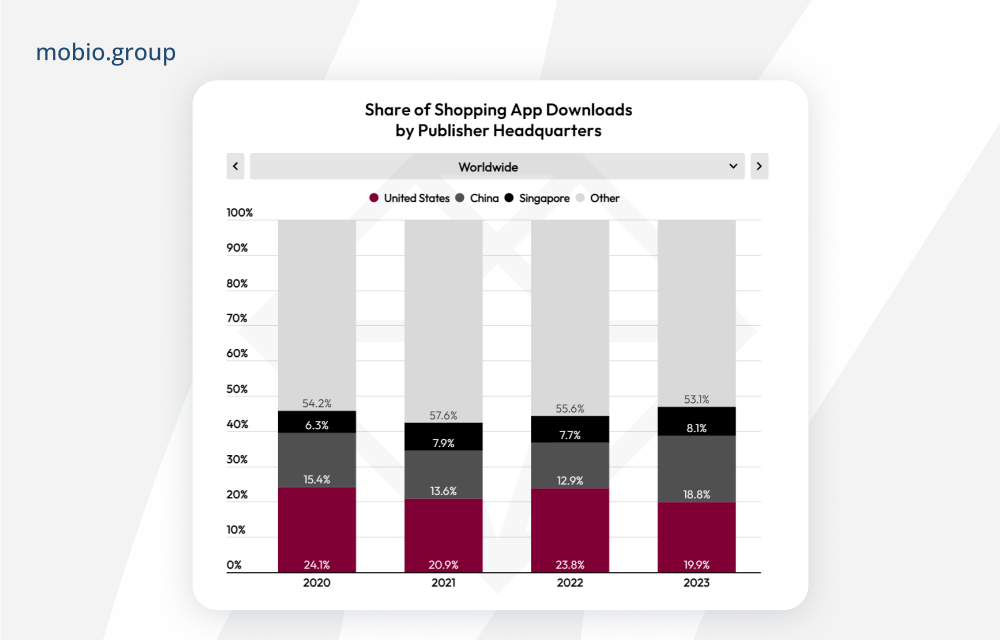

New major players have emerged in e-commerce: Temu, an app from Chinese company PDD Holdings, and Singapore-based SHEIN. Strong growth of Asian platforms has led to a decline in the US market share by 3.9% over 2023.

Video Streaming

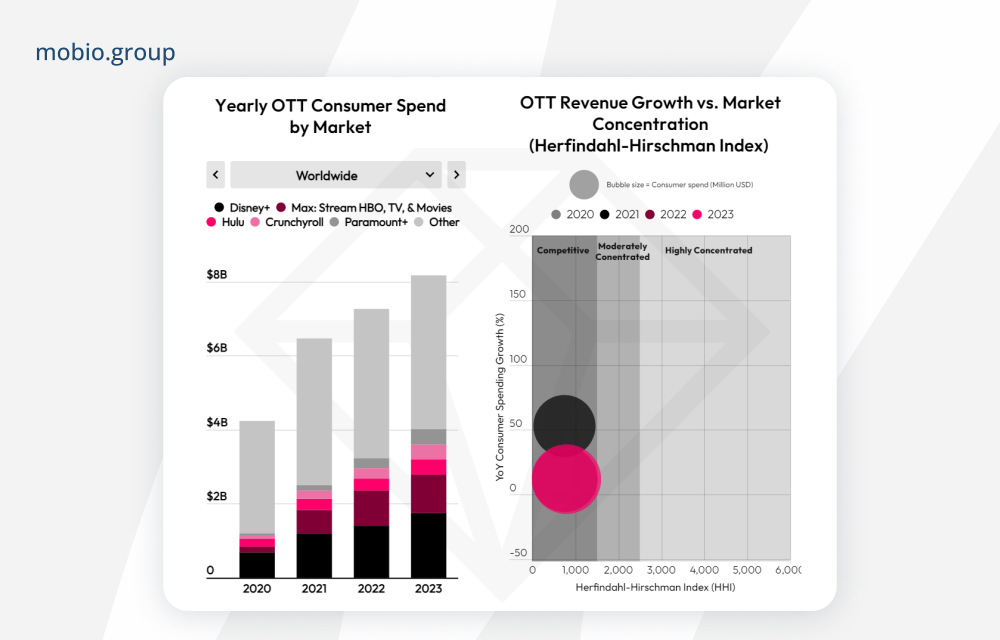

Consumer spending on OTT (over-the-top) streaming applications grew 13% globally to exceed $8 billion in 2023.

We can see a slight decrease in competition in the market — in 2023, the total market share of the top five streamers reached almost 50%, up from 45% in the previous year. Notably, Disney+, which has held the top spot for the past four years, has further increased its market share.

Competition and the economic environment have prompted leading apps to adjust their approaches to pricing and monetization. Netflix introduced an ad-based option, while Disney+ and Hulu, although they increased the price for ad-free viewing, did not change the price for the ad-supported version.

Social

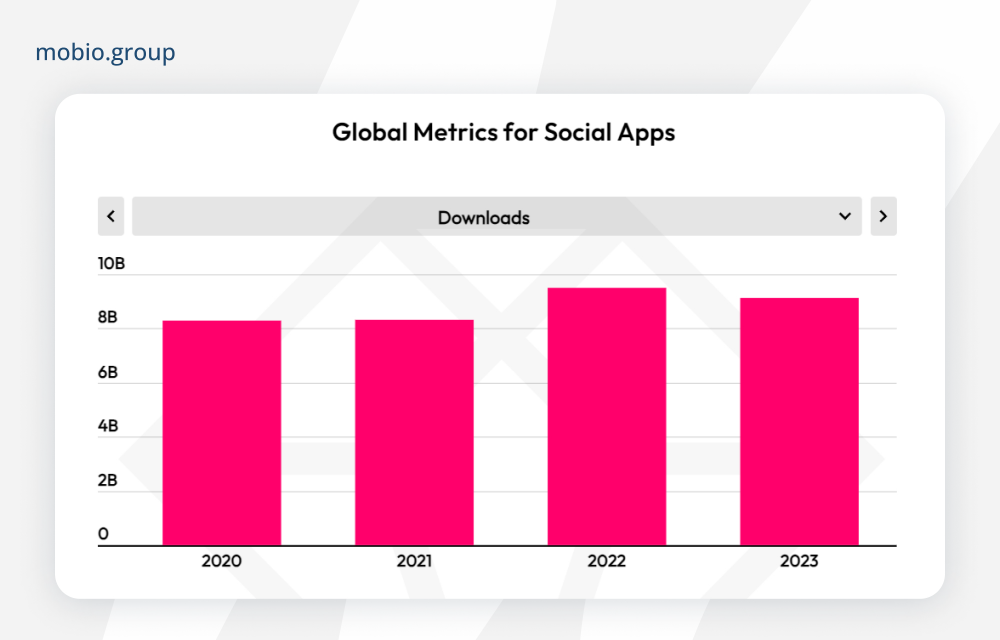

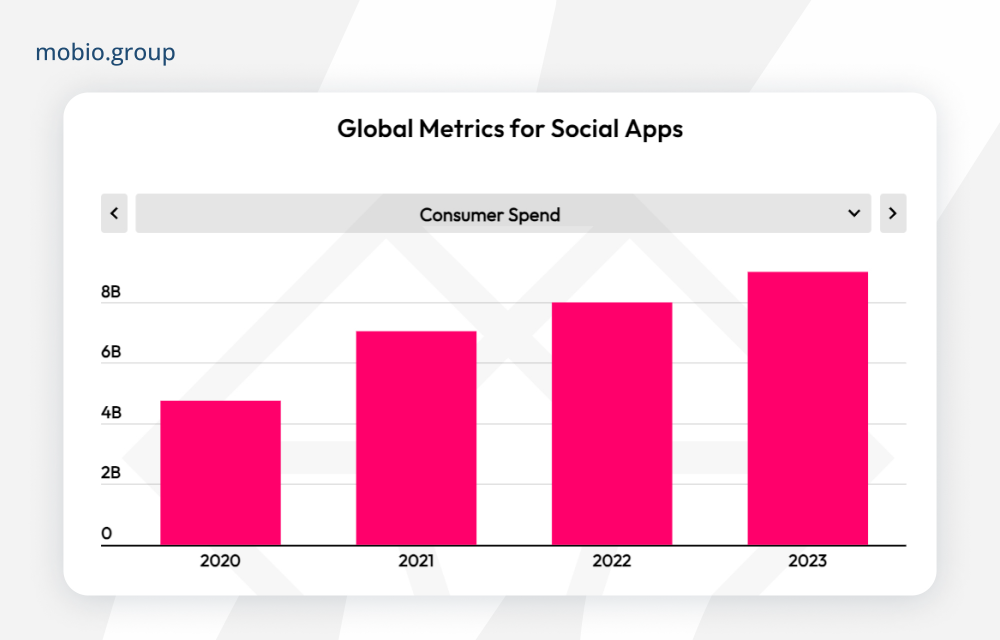

Overall, social media continues to grow steadily despite the fact that global downloads are down 3.9%. For example, according to Android phone statistics, social app usage time increased 9% to 2.3 trillion hours in 2023. And consumer spending grew 13% to nearly $9 billion.

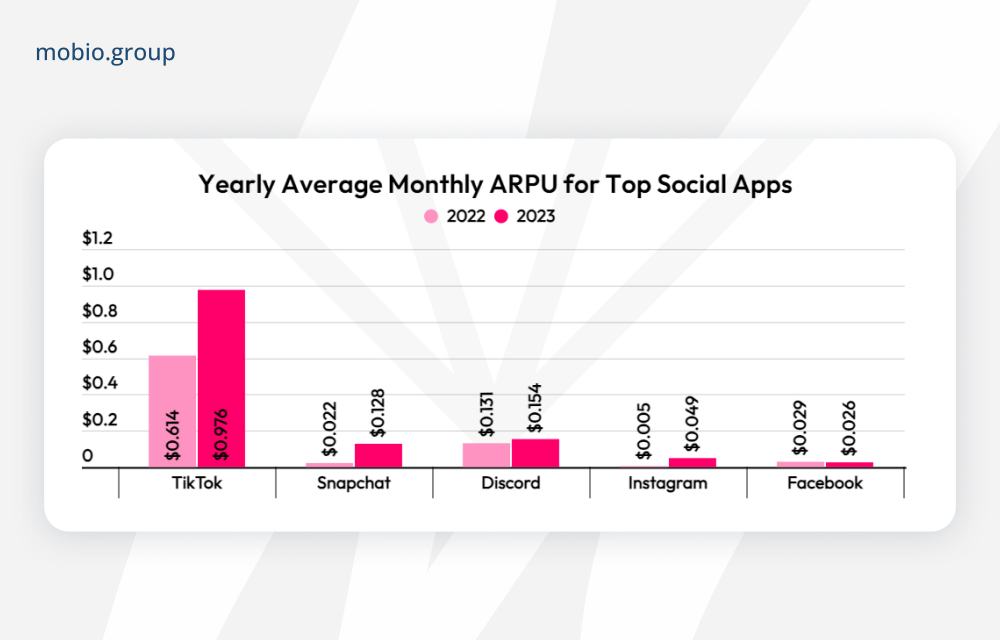

Microblogging usage is declining despite the launch of Threads and Bluesky platforms and X’s active attempts to retain subscribers. Users increasingly prefer visual-oriented applications. This is evidenced by the rapid growth of TikTok, with revenue reaching $10 billion in 2023. At the same time, most of the revenue from in-app purchases is generated by coins that allow users to tip content creators.

Most major social platforms, following the example of TikTok, are also trying to get away from advertising as the only way to earn money on mobile devices. For example, Snapchat has increased its revenue 5x with Snapchat+ subscriptions, and Instagram is trying to replicate TikTok’s success with the introduction of Instagram Badges.

It will be interesting to see how these attempts turn out, but so far TikTok is way ahead, earning $1 per US user, while second-placed Discord earns only 16 cents per user.

Food & Drink

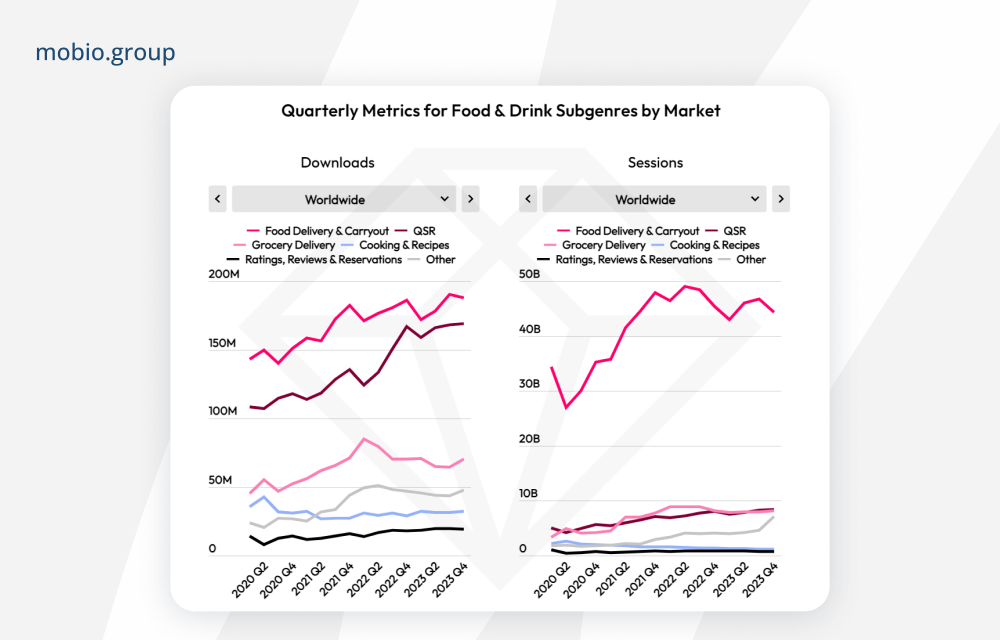

Food & Drink apps, which showed dramatic growth during the pandemic, maintained their position after the pandemic ended. This suggests that users have begun to accept ordering and delivering food via mobile apps as a weekly habit.

Leading QSRs such as McDonald’s, Starbucks, Domino’s Pizza, and KFC are actively capitalizing on this by making mobile apps an important part of their strategy. By adding loyalty and rewards programs to their apps, they attract users and increase engagement.

Travel

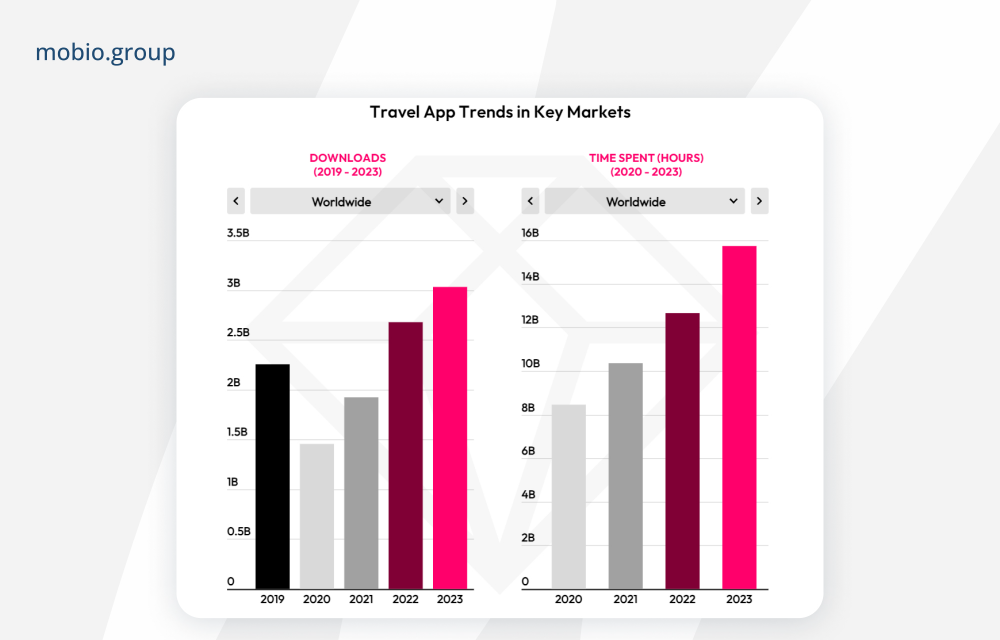

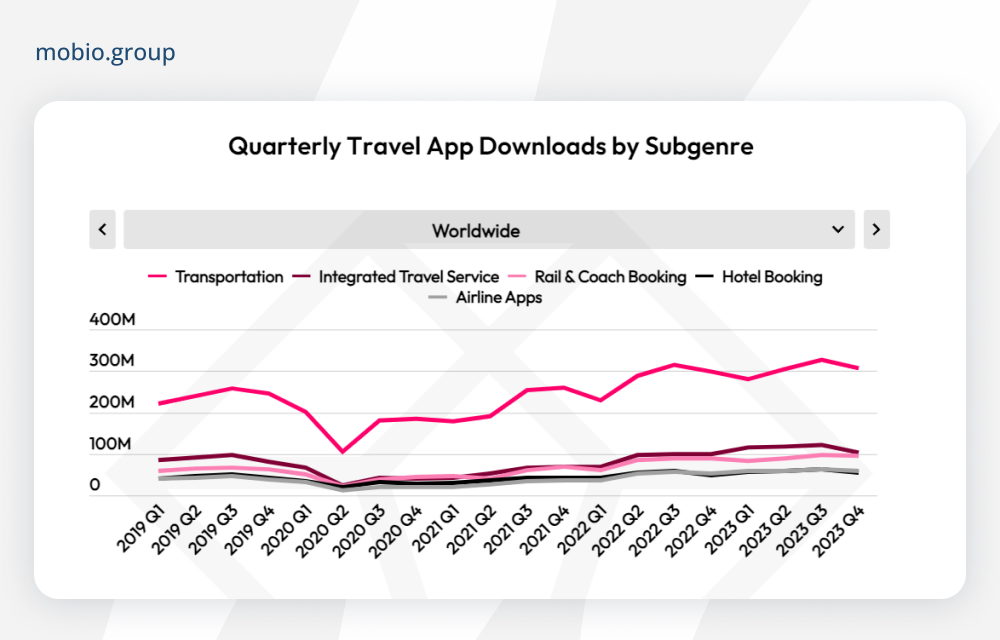

In 2023, travel category app downloads grew globally and across all sub-genres, including +34% for integrated travel services, +23% for airline apps and +16% for hotel bookings.

Health & Fitness

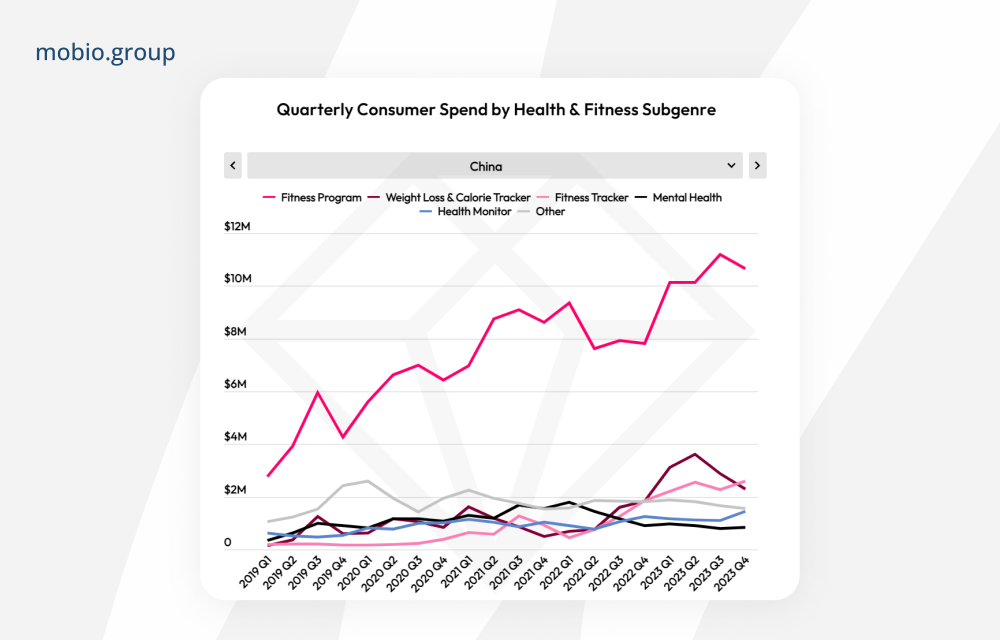

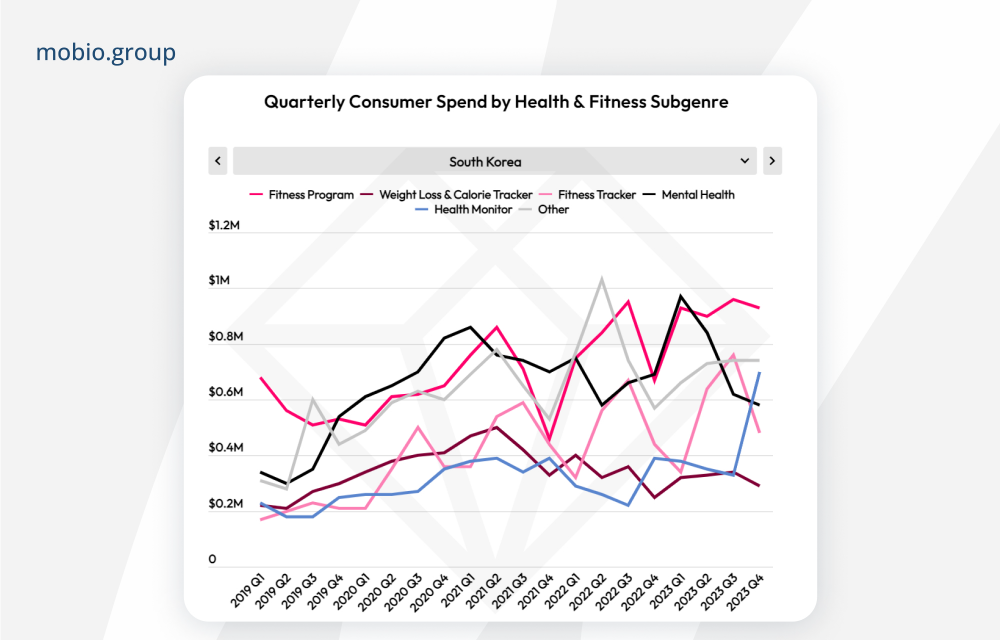

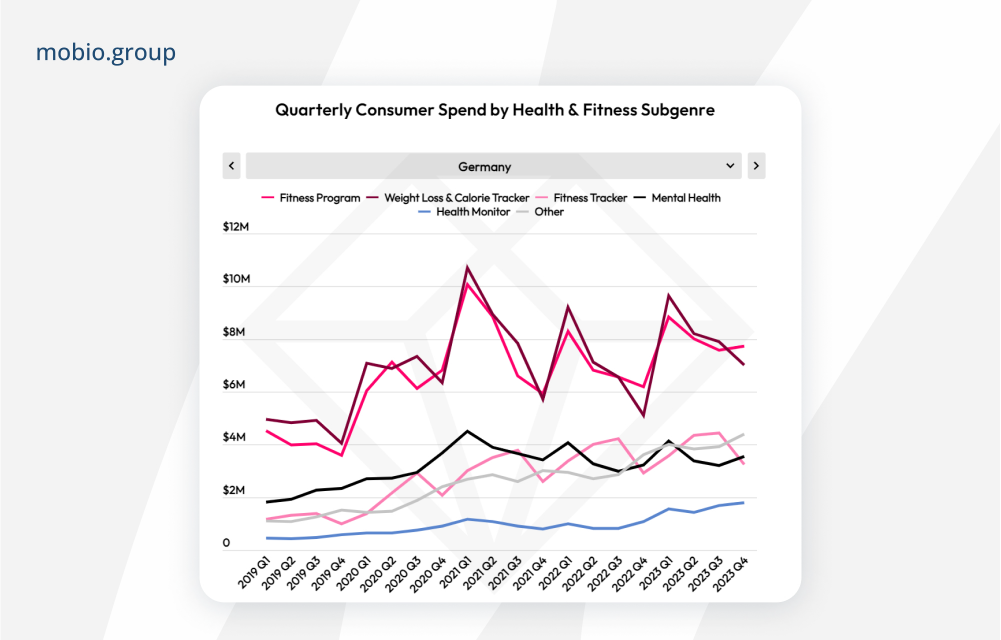

Health & Fitness category apps around the world perform well in terms of both downloads and consumer spending. But user preferences for different subcategories vary widely across markets and demographics.

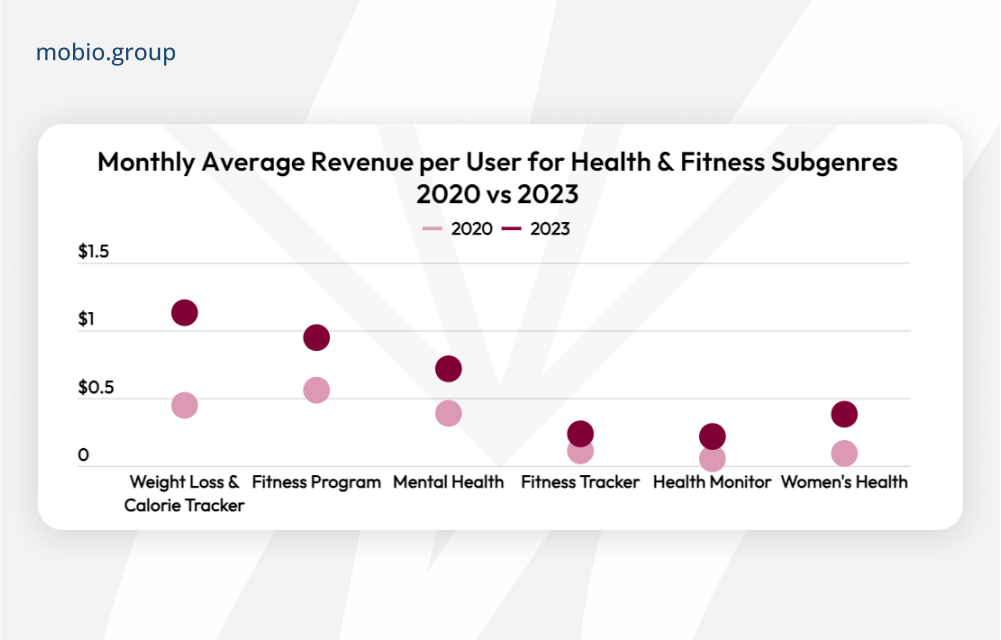

Nearly half of global consumer spending in the health and fitness category in 2023 came from the US, where the average revenue per user in nearly all sub-genres has doubled or more since 2020.

Sports

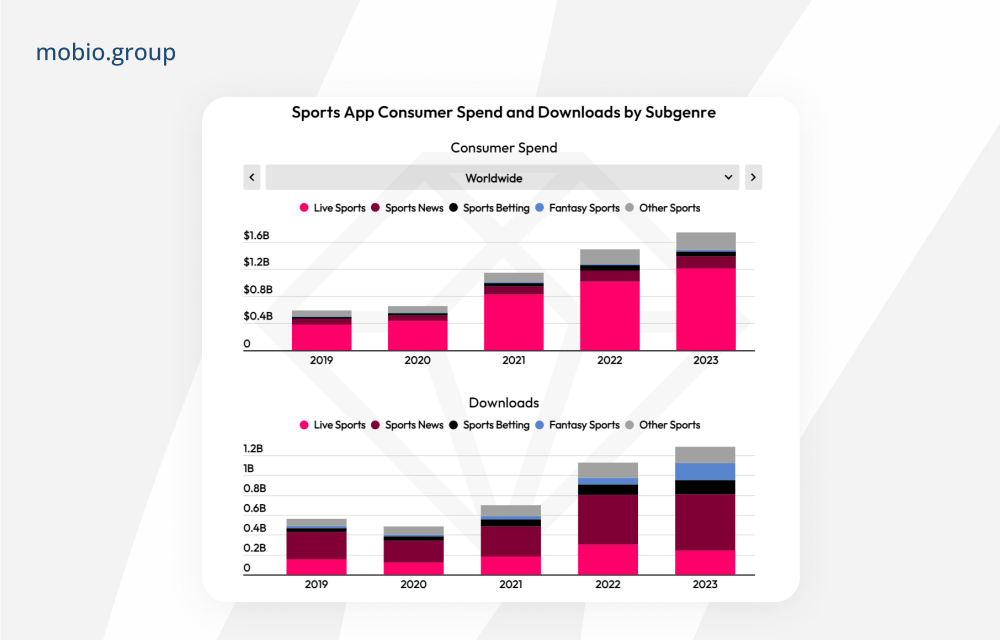

The sports app category saw a lull during the pandemic, but demand has been steadily increasing since the resumption of sports broadcasts. Consumer spending in this category in 2023 totaled $1.8 billion (+23% to 2022), the bulk of which is attributed to Live Sports.

If we look at the number of app downloads, the Live Sports subcategory on the contrary showed a significant decline. But after legalization in the US, sports betting is gaining momentum.

The leader in the growth of downloads in 2023 was fantasy sports, however, almost 85% of all downloads are in India.